This article was originally published in e27, one of our partners for our December series of Facebook Live Q&A focused on Startups. You can read the original article HERE.

Here is some legal advice for startups in one of the most exciting and fast-changing industries in 2016 to 2017

Lawyer WanHsi Yeong and Startupbootcamp FinTech Director Sam Hall did a Facebook Live Q&A with AsiaLawNetwork and e27, sharing practical tips for fintech startups. Below are the edited excerpts.

Let’s talk about the different types of regulation in Singapore

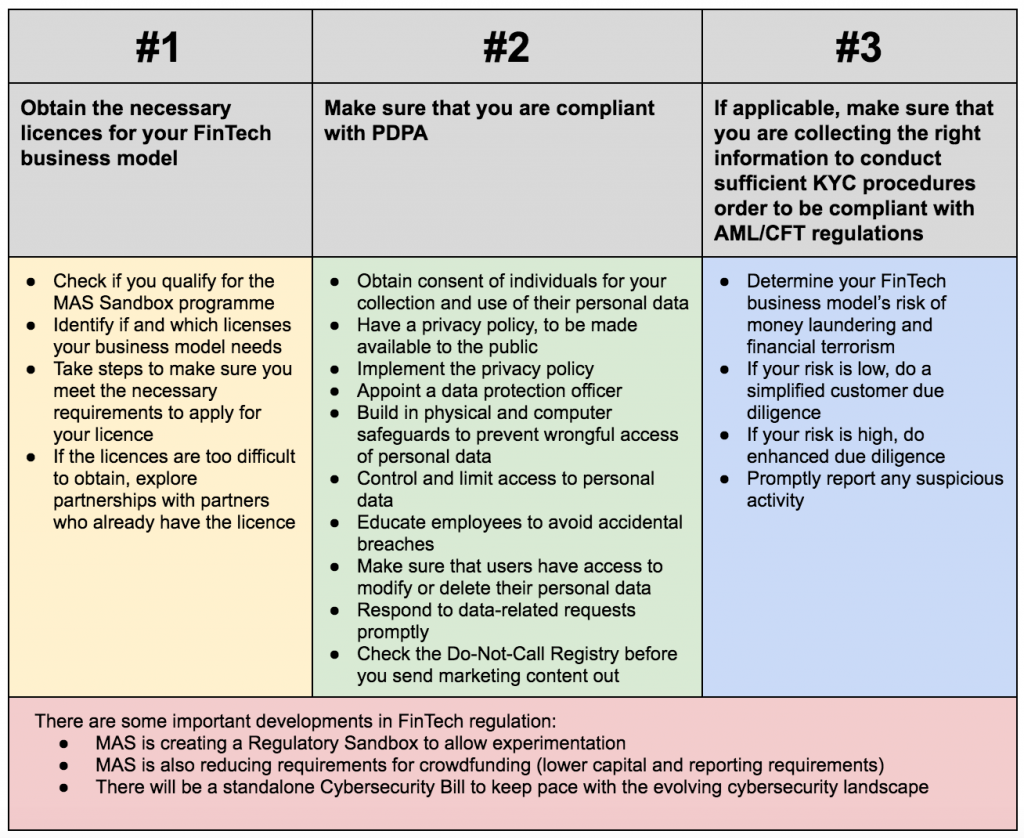

WanHsi: As I mentioned in my article, there are 3 major regulatory pillars for fintech.

- Secure the necessary licenses;

- Make sure you are PDPA compliant; and,

- Make sure you collect the right info to do KYC to be compliant with AML / CFT regulations.

You can read the full article here, and check out the table from it below.

As there is no unified regulatory framework for FinTech, different companies need to consider sector-specific regulation. If you collect, process and store personal customer data, PDPA becomes a prominent regulation for you to watch out for.

If you are involved in the payment space, money lending space or capital markets, there are specific requirements that you have to comply which and this include the Anti-Money Laundering (AML) and Countering of Terrorism Financing (CFT) controls.

Why has fintech developed so much in the past few years?

Sam: The development of fintech is a combination of opportunity, capital and infrastructure. There is a real opportunity to innovate and disrupt the financial industry. Entrepreneurs have different motivations to do so. Some target the industry because they know they can have success and make money. Other are in it to solve the problems in the financial industry.

As for capital, in the last few years, we have seen a huge willingness from investors to put money into fintech. This has allowed more entrepreneurs to pursue the opportunities in the industry.

Lastly, infrastructure has also encouraged the development of fintech in the past few years. With increased mobile and internet penetration, there are more opportunities forfintech companies to leverage on.

Moving forward, we are likely to see more developments in insurance tech or ‘insurtech’. This is another industry where there are huge areas to innovate.

What is the MAS Regulatory Sandbox?

WanHsi: The regulatory sandbox is a constructed well-defined space, within which companies can experiment with innovative fintech solutions in a relaxed regulatory environment and with the support of a national regulator for a limited period of time while they validate and test their business model. The MAS just released the guidelines for the sandbox last week, and you can read my article about it here.

What are some of the potential risks in joining the regulatory sandbox?

Sam: We have yet to see the amount of time and resources required for a fintech startup to complete a cycle in the sandbox. Startups have limited resources and opportunities. While the sandbox presents a huge opportunity for experimentation, there is a risk that you might be able to follow through with the sandbox.

Startups should also consider if the sandbox is the right fit. The sandbox is also only open to innovative and disruptive fintech startups. Not all startups are focused on this right now, and some might not qualify.

How will you respond to critics who say that fintech is just a fad?

WanHsi: The trend over the past three years is that fintech serves the underserved and unserved. There is a real value in the practical application of financial technology.

How does Singapore stack up against Hong Kong and other countries in terms of fintech regulation and development?

Sam: From a fintech Perspective, I am supremely happy with the role MAS is taking in pushing fintech forward. There are great links and ecosystems for fintech startups in Singapore.

The opportunities for fintech differ from country to country.In areas such as Indochina and Indonesia, there is appetite for solving problems related to payment and credit. But these are not the focus in areas like Hong Kong and Singapore since we have relatively more sophisticated payment systems.

WanHsi: In Hong Kong, the regulatory sandbox is only open to banks looking to use fintech as opposed to startup fintech firms. Contrastingly, the Monetary Authority of Singapore’s (MAS) regulatory sandbox is open to both new and existing fintech startups and financial institutions. The MAS has also set up a FinTech Innovation Lab, which is open to consultation. Startups who need advice on the different types of grants may approach the FinTech Innovation Lab.

Will the successful FinTech companies of the future be able to do it alone or will they need the partnership of a big company?

Sam: Working in tandem with a big company will definitely makes things easier. Some advantages include access to customers, data, marketing resources. If you are a new company without the relevant experience, it might also be difficult to get the necessary licence to operate your FinTech company. In Singapore, there are huge opportunities for startups to partner with banks. More and more banks want to work with startups in order to capitalise on great technology, team and ambition.

However, in some areas, people are definitely going in alone. We see this in the digital banks in Europe. For example, we are seeing digital banks such as Atom and Monzo that are built from the ground up.

WanHsi: Partnering with a big company might result in the fintech company losing its agility and nimbleness. In Singapore, the banks adopt different approaches. Some have in-house innovation hubs. But the difference between these hubs and fintech startups are that the startups are hungry. They lack capital and are constantly looking to innovate.

Which area of fintech faces the most difficulty in terms of regulations?

WanHsi: In terms of the payment and crowdfunding space, we have seen MAS propose a new National Payments Council which will help to harmonise the space.

Other areas where regulation will likely be a challenge include:

- Blockchain and Distributed Ledger

- Cybersecurity for cloud computing

Is a bank a viable exit strategy for your business?

Sam: As a default position, you should try to collaborate with as many partners as possible. You should not necessarily aim to work with the endgame of getting a bank to buy out your company. Rather, you should try to negotiate with several banks, across different jurisdictions. This will help your bottom line and be very useful during fund-raising.

WanHsi: If you’re providing Software-as-a-Service, you should definitely try to work with as many banks. The whole point is to make your technology accessible.

How can fintech companies figure out which regulations are relevant to their business?

Sam: I recommend reading WanHsi’s great article on which type of regulations are relevant for your startup

WanHsi: Thanks Sam!

What are some of the regulations that all fintech startups have to pay attention to?

WanHsi: All startups should ensure that they comply with regulations concerning confidentiality of customer information, Anti-Money Laundering (AML) and Countering of Terrorism Financing (CFT) controls.

Certain regulatory requirements will be relaxed for startups in the regulatory framework. However, after the sandbox expires, any relaxation will be lifted. The basis of the sandbox is for fintech startups to get their compliance in place. The startups are expected to fully comply with all relevant legal and regulatory obligations after exiting the sandbox.

Who are the best people to help fintech startups navigate in this space?

Sam: The first port of call is talking to the regulator. The MAS wants innovative and disruptive products that will move the economy and help Singapore move closer towards a Smart Nation. They are willing to provide assistance and you should definitely start having conversations with them.

Once you have figured out the type of regulation you fall under, that’s when you should talk to a lawyer to help understand the exact nature of your obligations.

Why should fintech startups engage a lawyer?

WanHsi: It’s important for startups to have regulation and compliance models in mind when building their product. You don’t want to be blocked in the middle of building your technology. A lawyer can help startups navigate through complex legislation.

Sam: Lawyers have great context and regulatory understanding. If you’re an entrepreneur, your startup should be supremely important for you. You should definitely try to get the best advice possible.

Why do you think China has experienced success in fintech innovation? How has regulations played a role in the development in China?

Sam: In China, capital is readily available. There is also strength of technology with the necessary business infrastructure and market size. All of these factors come together in a perfect storm.

What are the regulatory developments that you’re expecting to see in Singapore or in the region?

WanHsi: As mentioned earlier, the new National Payments Council is something that startups can look forward too given that it will act as a modular licence.

Sam: In insurance, MAS will now allow insurers to offer the full suite of life insurance products online. This will be an exciting development in Singapore.

What kind of challenges do fintech startups face?

Sam: There are multiple challenges that include working capital and growth. In FinTech, Regulation is also definitely an issue since it can delay growth and development.

WanHsi: Working is the main issue for most startups since it can determine how successful their product can be.

The crowdfunding equity community sort of built their companies first and then prayed MAS approved the industry. Is this a valid strategy in Singapore if your business is not entirely ‘legal’ by MAS standards?

Sam: If you look at the regulatory sandbox, the FinTech solution has to be technologically innovative and must bring benefits to a large group of customers. In principle, if your company is solving a problem that takes the industry forward, it should be approved by MAS.

WanHsi: In Singapore, the benefit is that companies have a space to consult. If you have any uncertainties or queries, you should definitely check with the FinTech Innovation Lab. As for specific examples, the MAS clearly regulates securities-based crowdfunding and lending-based crowdfunding. You will need a capital market licence in these areas. In other areas, there is always the regulatory sandbox for you to experiment in.

What are the Practical Tips you have for fintech startups?

Sam: In order of importance:

- Apply to the Startupbootcamp FinTech Accelerator in Singapore. Applications close at the start in February 2017.

- Make sure you are talking to the regulator and are cognisant of what rules you need to abide by.

- Do your research from the very start and understand the regulatory framework.

WanHsi: Startups should factor the regulatory framework into their product and business model. Most people take regulatory compliance as a burden. You should instead take is an investment, so that your product will be robust and will work in the market.

—-

You can watch this Facebook Live interview here.

Need legal advice for your FinTech Startup?

WanHsi is available for a Quick Consult to advise you on a specific legal matter and answer your questions for your startup on the phone for a transparent, flat fee starting at S$49 here.

This article is written by Gabriel The from Asia Law Network.

This article does not constitute legal advice or a legal opinion on any matter discussed and, accordingly, it should not be relied upon. It should not be regarded as a comprehensive statement of the law and practice in this area. If you require any advice or information, please speak to practicing lawyer in your jurisdiction. No individual who is a member, partner, shareholder or consultant of, in or to any constituent part of Interstellar Group Pte. Ltd. accepts or assumes responsibility, or has any liability, to any person in respect of this article.