#1 InsurTech – What is it?

The word ‘InsurTech’ is a portmanteau of the words ‘Insurance’ and ‘Technology’. Essentially, it is the use of technology to innovate and facilitate efficiency and cost-savings in all areas of the insurance industry.

InsurTech is seeking to disrupt the insurance industry

Just as we are witnessing a radical and positive transformation in the banking and financial world brought about by the FinTech revolution, InsurTech startups are likewise seeking to transform the insurance industry through technological innovation.

The insurance industry has been relatively slow to adopt technology

Despite being one of the oldest industries in the world, the insurance industry has (relative to the banking and financial industries) been less responsive towards the technological advancements that are rapidly transforming the world outside of it, particularly developments in the FinTech space. As such, some insurance companies that have previously thrived under the traditional business model now face a new and imminent challenge today – to innovate and implement change or face the risk of business disruption and/or loss. As recent as last year, PwC’s Global Fintech Survey 2016 reported that while 43% of the players in the insurance industry consider FinTech as part of their corporate strategies, only 28% explore partnerships with FinTech companies and less than 14% had an active participation in ventures and/or incubator programs.

The rise of the InsurTech startup

To this end, the surge in the inception of insurance startups over the past two years should be welcomed by both insurers and consumers/end-users alike. Being predominantly data-driven, InsurTech brings to a traditional industry a new and different set of expertise. It offers opportunities to innovate, collaborate, partner to further refine insurance solutions — whether it is to price and offer insurance products with more flexibility, efficiency and precision, broaden and improve insurance coverage, eliminate error and fraud or improve customer experience etc. In essence, InsurTech companies have been positive for the insurance industry. They are solution providers who create value for the industry, and in the process make insurance products and services more competitive for the consumer/end-user.

Singapore Government is creating a framework to encourage innovation in InsurTech

The Singapore government clearly recognises the potential of FinTech in reshaping traditional businesses. In accordance with global trends, the interest in insurance innovation has also been growing in Asia with a notable increase in the presence of InsurTech startups based in Singapore. This is expected to continue. The Monetary Authority of Singapore (“MAS”), which regulates and oversees all insurance activities has been continuously and actively putting into place policies to promote digital innovation – a clear stance of the country welcoming local, regional and international InsurTech companies.

#2 Impact of technology along the Insurance value chain

Technology and the availability of new and big data sources are rapidly and increasingly having an impact on insurance. Digitalised information is now being used to improve processes all along the insurance value chain.

Robo-advisors – A main theme in the provision of Digital Advisory Services

InsurTech businesses primarily operate on the digital platform. This is the main feature they bring to the insurance industry, setting them apart from conventional advisers. This increasingly popular mode of providing digital advisory services enable customers seeking insurance products and services to directly access the products or services offered with limited or no interaction with human advisers. Known as ‘client-facing tools’, such advisory tools use “robo-advisers” to provide advice through automated, algorithm-based tools. More tech-enabled solutions are emerging across all insurance lines of business as customers increasingly expect interactions to be mobile first.

There are various ways in which InsurTech businesses can provide digital advisory services. This will also vary in accordance with the type of InsurTech business that is carried out. Nonetheless, as long as it falls within the definition of providing financial advice, businesses will need to ensure that they are duly licensed under the Financial Advisers Act (Cap. 110) unless they fall under the exemptions prescribed by the MAS.

Robo-advisor startups must be sure there is a reasonable basis for recommending an investment

It has been pointed out that Section 27 of the Financial Advisers Act requires there to be a reasonable basis for recommending any investment product to a person. Such reasonableness can be satisfied through giving due consideration to the investment objectives, financial situation and particular needs of the person, as pursuant to the Notice on Recommendations on Investment Products [Notice No. FAA-N16]. MAS notes that client-facing tools rely solely on the information provided by the customer and thus may not satisfy all the requirements under Notice No. FAA-N16, and meet the standards required by Section 27 of the FAA. While MAS indicates that it will consider relaxing the regulatory requirements, and will be willing to grant exemptions on a case-by-case basis, it will be prudent meanwhile for InsurTech companies to take all necessary steps to ensure that their investment recommendations are given within reason. The only exception can be enjoyed by direct life insurers licenced under the Insurance Act. InsurTech businesses looking to distribute life policies will be allowed to offer on the online direct channel with no advice provided, provided they have obtained their licence, and observe the guidelines provided by the MAS.

Onus on digital advisor to make sure advice is aligned with the Financial Advisors Act

The MAS has also identified a unique and potential risk posed by digital advisers. It observes that in the provision of digital advice, the application of such client-facing tools may be susceptible to the risk of erroneous or biased algorithms. As such, the MAS has clearly stated that the onus is on the digital adviser to ensure that the tool used will satisfy the requirements under the Financial Advisers Act. To this end, the MAS is expected to set out minimum expectations on the standard of governance and management oversight expected of digital advisers, including the responsibility of the Board and Senior Management for the monitoring and control of algorithms.

The Internet of Things is changing the InsurTech industry

Essentially, the ‘Internet of Things’ (IoT) is a move to increasingly connect electronic devices to the internet. This includes anything from mobile phones, washing machines, coffee machines, lights, and wearable devices. The analyst firm Gartner predicts that by 2020, the ‘Internet of Things’ network will include up to 26 billion devices. On the IoT, connections will be between people, people and their devices, and between devices.

The IoT is predicted to have a massive impact on the insurance industry, both in the prediction and minimisation of risk, and insight into customer profiles and behaviour. This is due to opportunities for increasing connectivity, data collection, and monitoring of the consumer base.

For example, insurers may be able to take a more proactive approach by warning their consumers of potential loss even before it occurs. Jon Carter, Deutsche Telekom’s UK Head of Business Development for the Connected Home, has noted that ‘roughly, a 1/3 of all household claims relate to water leaks. By connecting a small device, such as Water Hero or Gem sensor to a home’s main pipes, water flow can be monitored continuously. As soon as an anomaly in flow rates is identified, the customer and/or insurer is alerted to take proactive action.’ Such preventative approaches are made possible through the use of ‘smart’ devices in the home. Insurers benefit as it lowers their costs; the insured benefit because they avoid a loss.

The use of smart devices in the home and wearable devices such as fitness trackers and smart watches is also a big opportunity for insurers to track users’ habits and behaviour. The collection of data enables insurers to better advise consumers, provide personalised policies, and calculate risk more accurately. Further, with greater insight into consumer habits, insurers are able to develop new products created to fill niche areas in the market previously undetected.

IoT has enormous potential to change the insurance industry. However, in order to harness this potential for the benefit of the industry, insurers must remain conscious that a steady flow of IoT data will be necessary and must remain available for their use. Availability of such data will depend in part on consumers’ willingness to make a move into increased internet connectivity. Consumers may have concerns about privacy and the protection of their data.

#3 InsurTech – The Common types/categories of InsurTech Startups

It is crucial for entrepreneurs and startups looking to enter the InsurTech space in Singapore to ensure compliance with the licensing, regulatory and capital requirements. These requirements will vary according to the type of InsurTech business one is looking to enter into.

On the market today, there are many different types of InsurTech businesses, with new ones constantly emerging. The variety of products and services offered may range from insurance management to processing, sales, data, infrastructure, software, and P2P etc.

Solely for the purpose of outlining the regulations, only 3 common categories will be illustrated here.

- InsurTech Aggregator / Marketplace;

- InsurTech Intermediaries — Brokers / Agents; and

- The Full Stack InsurTech.

InsurTech Aggregator / Marketplace

The aggregator model creates an immediate tangible value. It provides a streamlined marketplace for insurance, often directly offering the consumer/end-user products and services without having to go through middlemen/agents/brokers and thus cutting out the costs associated with such engagements.

Significantly, customers can usually compare the policy terms of different products and services and their prices. This makes it easier for them to make informed choices. Aggregators benefit both insurers and customers – the former by providing them with a platform to directly reach prospective customers, and the latter through enhancing their user-experience by offering accessibility, convenience and choice.

Generally, an InsurTech company that is carrying out business purely as an aggregator would be clearly distinct from that carrying out business as an intermediary. Unlike an intermediary, aggregators do not originate, underwrite, or issue any insurance policy and/or insurance contract. An aggregator merely performs the role of providing a platform to facilitate transactions (passive), whereas the intermediary carries on the (active) business of acting for parties in providing advice and arranging their insurance transactions. Therefore, in principle, aggregators will not require the same licenses as the intermediaries. Nonetheless, in practice, the lines can be easily blurred.

It is therefore imperative that any prospective InsurTech aggregator is clear on this distinction. Aggregators are advised to exercise caution and not overstep its boundaries. If there is an intention to venture into the business of selling, issuing, originating or underwriting insurance policies, it must first obtain the applicable licences under the Insurance Act, whether as a licensed insurer/ insurance broker. If advice is rendered as part of the service provided (this of course includes digital advice), then a financial advisory licence will need to be obtained as it will fall within the scope of the Financial Advisers Act (Cap. 110) of providing financial advisory service.

Provision of Digital Advice

In accordance with the recent consultation paper by the MAS, it appears that digital advisory business models such as digital platforms that pass on customer trade order to brokerage firms for execution, or those that refer clients to open accounts directly with brokerage firms and do not handle clients’ moneys as part of the investment process, will likewise be required to be licensed under the Financial Advisers Act.

Examples of InsurTech Aggregator / Marketplace Companies

PolicyPal is a Singapore company that was founded in 2016 to provide policyholders with an overview of their existing insurance coverage and assist them in identifying ‘gaps’ in their coverage. Users can download the mobile app, upload their existing policies and are provided with in-app analysis of their existing coverage. Users are also able to compare policies from different insurers according to their life stage/type of coverage desired, with the option of purchasing additional insurance coverage directly from insurance companies.

Similarly, Policybazaar is an Indian company providing online insurance brokerage services, enabling users to compare insurance products from various insurance companies according to factors such as price, quality, and key benefits. Users are then redirected to the insurers’ company platform for the purchase of their selected insurance products.

PolicyStreet is a Malaysian company that was provided in 2017 and sells a variety of curated insurance policies, which can be selected according to consumer needs. Their products range from insurance for travel and personal accidents, to insurance for dengue and pets. Once users have decided on a particular product, they are able to purchase that product online and receive it instantly, or select the option to ‘Purchase Offline Now’ and obtain that product through insurance agents.

InsurTech Intermediaries – Brokers/ Agents

In the course of conducting its business, many InsurTech companies will assume the role of an agent for persons in respect of their insurance policies. An InsurTech company that is engaged in any such conduct (and which is not carrying on business as an insurer or reinsurer) will be required to apply to the MAS to be registered as an insurance broker.

Insurance is a multifaceted business. This means that the majority of InsurTech companies and/or its representatives are likely at some point to receive proposals for insurance policies, issue insurance policies, collect/receive premiums on policies, or in some way arrange insurance contracts. Such conduct will come under the ambit of the Insurance Act (Cap. 142).

Furthermore, pursuant to the Insurance Act and Insurance Intermediaries Act (Cap. 142A), even if an InsurTech company is a licensed insurer or licensed insurance broker, it must still ensure that there is a written agreement in place with each of its representatives/ agents to authorise them to arrange any contract or contract of insurance on behalf of the company.

Provision of Digital Advisory Services

Ensure compliance.

Examples of InsurTech Intermediaries

Insurance Market is a Singapore company functioning as an online broker/agent for a variety of insurance companies. There is overlap with regard to the functions of an insurance aggregator/marketplace as Insurance Market enables users to specify the types of policies desired, and compare and contrast policies from various insurers according to price range, coverage score, or value for money. However, it also acts as an insurance broker in that users are able to purchase policies directly from the company, rather than from the insurers themselves.

Coverfox Insurance Broking is an Indian startup insurance broking company offering products such as automobile, life, health, and travel insurance products. Users select their preferred insurance product category, then are asked to key in a few personal details before the company provides them with a variety of insurance products to choose from. Users are then able to purchase policies directly from the company website.

Full Stack InsurTech

InsurTech companies looking at this approach are those seeking to build a complete end-to-end product or service, and to deliver their own unique customer experience while retaining full control throughout the entire process.

Companies in this category primarily carry on an insurance/reinsurance business. They seek to bring into the business a focus and/or reliance on digital innovation. However, without the necessary licenses, the law will not permit the company to operate and carry out any insurance or related activity in Singapore, whether it is the receipt of proposals for policies, issuance of policies, collecting or receive premiums on policies or the assumption of risk for policies issued.

As such, these companies are subject to considerable regulation. Subject to the changes which the MAS may prescribe from time to time, the following is a quick overview of the salient points to note for an InsurTech going for full stack:

(a) Apply for the appropriate license pursuant to the Insurance Act (Cap.142)

The company needs to apply to with the MAS be a licensed insurer. Generally, there are 2 different classes of licenses a company may apply for:

- direct life insurance business license (inclusive of life policies, long-term accident and health policies); or

- general insurance business license (inclusive of all types of insurance business except life policies).

If a company is seeking to apply as a foreign insurer, it is required to have been approved by the law of another country/territory to carry on insurance business in that country/territory, and the business must fall under the foreign insurer scheme of the Insurance Act.

(b) Satisfy the admission criteria (including the financial requirements)

In granting insurance licenses, the MAS will assess the applicant through a consideration of various factors, including its premiums and assets, credit rating, track record, financial soundness, reputation, innovation, business strategy and plans, risk management system, fitness and propriety of directors and key executives.

InsurTech investors/entrepreneurs/startups that are setting up will also need to have capital readily available to satisfy the financial conditions required by the MAS. For direct insurers, this includes a minimum share capital requirement of SGD 5 million for life insurance business and /or SGD 10 million for non-life business. For reinsurers, the requirement is SGD 25 million and an additional SGD 2 million for each class of insurance/reinsurance service which the company intends to provide.

Note that once licensed, annual fees will be payable to the MAS. Such fees will differ for different classes of insurance business or for different types of licensed insurers.

(c) Appointment of Key Persons

A licensed insurer is required to have amongst its required appointments a (i) chief executive, (ii) appointed actuary (for life business) or certifying actuary (for general/non-life business), and (iii) a chairman from amongst its directors. In making such appointments, the company must obtain approval from the MAS. The MAS will have to be satisfied that such individuals are considered fit and proper to be appointed.

(d) Ongoing Compliance Requirements

- Meet the Fund Solvency & Capital adequacy requirements – In essence a minimum sum of money/assets required to be set aside by the company for purposes of meeting liabilities (to be assessed by the MAS).

- Maintain the necessary books and records (including statements of accounts and particularly register of policies) to explain the transactions and financial position of the InsurTech company and to do so in a manner that such books and records can be conveniently produced to be properly audited.

- Ensure there is a distinct & separate fund for each class of insurance business.

- Ensure an investigation is carried out each accounting period on the financial condition of each class of insurance business – This must be conducted by an actuary approved by the MAS, and the investigation report must be lodged with the MAS accordingly.

Financial Adviser’s Licence

A financial adviser’s licence under the Financial Advisers Act (Cap. 110) will not be necessary, provided that the InsurTech company has duly obtained its licence under the Insurance Act (Cap.142). The latter will be sufficient for the InsurTech company to provide financial advisory services.

Provision of Digital Advisory Services

Ensure compliance.

Examples of Full Stack InsurTech Companies

DirectAsia is a full-stack insurance provider in Singapore, representing and selling their own insurance policies. Products include car, motorcycle, and travel insurance. Online services enable users to obtain an instant quote for the insurance products of their choice, and the transaction can be completed on the same day. Claims are also submitted and handled online. The company aims to provide affordable, hassle-free products for their consumers.

China’s Zhong An is the country’s first wholly digital insurance provider. Zhong An enables clients to conduct the entire insurance process online, from the reviewing and purchasing of its insurance products to the submission of claims. The model is successful largely because it overcomes challenges in distribution in China- with increasing access to digital technology in the country, the company is able to reach a larger consumer base through wholly online services.

BIMA is a full stack insurance provider founded in Stockholm but growing rapidly in regions such as Africa, Asia, and Latin America. The company targets low-income families and uses mobile-based technology to bring insurance and health services to areas where in-person distribution would otherwise be difficult. The majority of BIMA’s current consumer base lives on less than $10 per day. Believing that insurance can transform the lives of low-income families due to their lack of financial resources during times of illness or injury, BIMA offers low-cost insurance products with a focus on affordability and accessibility.

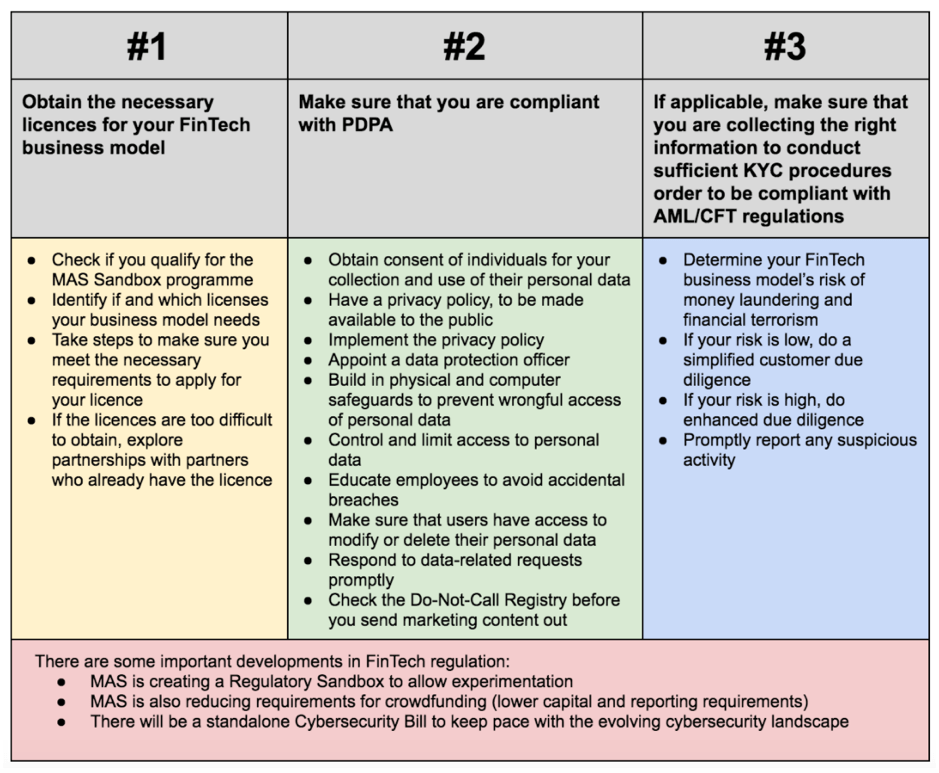

#4 Other Regulatory Requirements

Personal Data Protection & Anti-Money Laundering & Counter Financial Terrorism (‘AML’) Controls

In our earlier article, we have set out the requirements of these areas as these are important aspects of any business (particularly the financial industry) to adhere to. There are 3 major regulatory pillars that Fintech have to address if they want to not run afoul of regulators and build a lasting, sustainable Fintech business. Read our earlier article for a more detailed discussion on Fintech Regulations in Singapore – what you need to know, simplified.

It is no different to the insurance industry and in most cases, the insurance businesses cover the mass market. It is imperative to obtain the consent of the respective individuals before the insurance businesses can collect and use the potential customer’s personal data. Specific policies and appointment of a data protection officer must be in place. Necessary internal controls need to be in place which can withstand rigorous audits to be implemented and in line with best market practice as set out by the MAS.

AML will be another necessary area to be set up with the dedicated appointment of an AML officer to ensure the proceeds of the premiums are clean, free and not from a tainted source. Whilst it is up to the business to decide whether to proceed with a simplified or enhanced customer due diligence since it is a principle based assessment, the onus is likely to fall on the businesses to ensure it is in compliant with the AML prevailing laws at the time.

The MAS FinTech Regulatory Sandbox

The MAS acknowledges the complex nature of the rapidly evolving technological landscape. It recognises that this might result in uncertainty of legal and regulatory requirements, thus deterring entrepreneurs/startups in the FinTech space from experimenting with innovative financial products and/or services. To circumvent this, the ‘MAS FinTech Regulatory Sandbox’ was put in place to encourage entrepreneurs/startups to continue innovation and experimentation within a well-defined space and duration.

An InsurTech company which is an approved Sandbox Entity will benefit from guidance and regulatory support by the MAS. It will be given room to launch its products and services in a conducive flexible environment. Importantly, as a Sandbox Entity, the MAS may relax certain specific regulatory requirements for the InsurTech company which it would otherwise be subject to.

Regulation will continue apace as the industry develops

Regulation is expected to change and adapt at a fast pace to cater to the evolving FinTech landscape. The current assessment of the regulatory landscape is generally positive for InsurTech companies. The MAS has been responsive to developments and has been refining regulation to suit business efficacy. This has been evident in various areas, particularly in the area of digital advisory services where most InsurTech companies ply their trade.

Notwithstanding, InsurTech companies will need to constantly keep abreast of developments to stay competitive. Staying informed and ahead of the competition in this regulated industry can be a tremendous source of competitive advantage.

I’m excited to see how technology is going to change this industry. It’s overdue.

Get advice on Insurtech regulations from WanHsi

WanHsi is available to give legal advice and answer your questions on Insurtech and Fintech via an Asia Law Network Quick Consult. Check out online in minutes and have WanHsi or a lawyer with expertise in Fintech experience call you back within 1-2 days for a transparent, flat fee of S$49. WanHsi and her firm ArrowGates LLC also provides Quick Contracts to help startups draft their most important contracts for a transparent, flat fee.

This article is written by Yeong WanHsi and Sherroy Ong from Arrowgates LLC with editing by Danon Gabriel The.

You may be interested in the following articles:

- Pro Bono: Practical fintech startup legal advice from lawyer WanHsi Yeong and Startupbootcamp fintech director Sam Hall

- Fintech Regulation in Singapore — What you need to know, simplified

This article does not constitute legal advice or a legal opinion on any matter discussed and, accordingly, it should not be relied upon. It should not be regarded as a comprehensive statement of the law and practice in this area. If you require any advice or information, please speak to practicing lawyer in your jurisdiction. No individual who is a member, partner, shareholder or consultant of, in or to any constituent part of Interstellar Group Pte. Ltd. accepts or assumes responsibility, or has any liability, to any person in respect of this article.